Latest News

It has been a rich period for India’s start-up ecosystem, with as many as 48 newborn businesses riding the new digital wave to command valuations of $1 billion or more. Can they live up to their early promise and create sustainably profitable businesses?

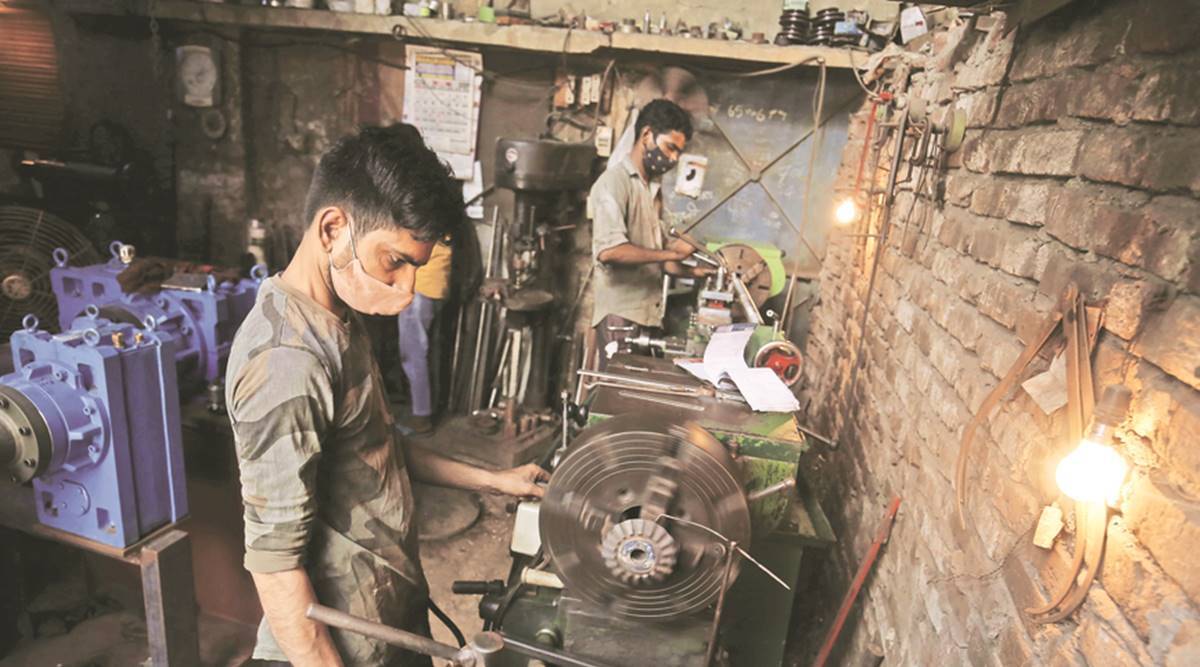

Ease of Doing Business for MSMEs: The portal allowed MSME associations, units, employees, and aspiring entrepreneurs, etc. to file complaints, share suggestions or seek information on the available government support to MSMEs.

The finance minister made the statement during question hour in Parliament on July 26 while clarifying the government’s position on clearing dues owed to MSMEs by the Centre and its PSUs.

The central government’s measures such as enacting the Insolvency and Bankruptcy Code (IBC) along with strengthening other laws have enabled the banks to recovers bad debt amounting to Rs 5.5 lakh crore.

In fact, about Rs 1 lakh crore of this sum has been recuperated from accounts that were…

There are many links in the chain responsible for prevention as well detection of frauds. Auditors, however, have always found themselves at the centrestage whenever it comes to fixing accountability and liability for occurrence of frauds.

Credit offtake by the industry had grown 2.2 per cent in the previous year.

While the IBC has greatly improved the prospects of mergers and acquisition of distressed assets, many challenges still remain in their smooth takeover.

Piyush Goyal mentioned about the reduction in filing fees for startups, MSMEs and women entrepreneurs — allowed by the department — by 80 percent to help and support startups and women entrepreneurs in the country.

However, a majority of traders are also seeking relaxations in proposed ecommerce rules to be framed by the government, said a report by LocalCircles.

Digitalisation in the Indian financial sector began in the early 90s when Automated Teller Machines (ATM) and Electronic Fund Transfers (EFT) were introduced. Soon after, internet banking was permitted, followed by the NEFT, IMPS, RTGS, etc. In the last few years, the National Payments Corporation

The pandemic-induced lockdown has taught MSMEs how to reorganise and adapt in a changing environment. Small businesses now look at sourcing, diversification and capital allocation more closely. Will these lessons help the growth engine get back on track?

Strong rebound in credit demand, accompanied by equally strong credit supply and Emergency Credit Line Guarantee Scheme (ECLGS) support, led to growth in the credit outstanding amount of MSME sector to Rs 20.21 lakh crore, with year-on-year growth of 6.6 per cent, says a report from TransUnion Cibil…

The list of companies whose RPs have filed such claims is said to include Aircel, Videocon, Reliance Communications, Jaypee Infratech, LancoInfratech, Bhushan Power and Steel, Bhushan Steel and Educomp Infra, among others.

An amendment of law is set to ease norms and let non-specialist NBFCs into the business of buying unpaid bills. MSMEs under stress could encash their dues if this market kicks off

Unacademy’s CEO Gaurav Munjal says Zomato’s Deepinder Goyal and OYO’s Ritesh Agarwal also participated in this round of funding, along with South Korea’s Mirae Asset as new investors.

Speaking on the Bill in the Rajya Sabha, Sitharaman said, “You can imagine the number of MSMEs that will directly benefit because of this.”

Although the pandemic has affected firms of all sizes, but SMEs have been more vulnerable.

Delhi-based digital escrow startup Castler has been registering around 6,000 transactions every month with cumulative transaction value at Rs 80 crore.

Delhi-based digital escrow startup Castler has been registering around 6,000 transactions every month with cumulative transaction value at Rs 80 crore.